It’s all about incentives

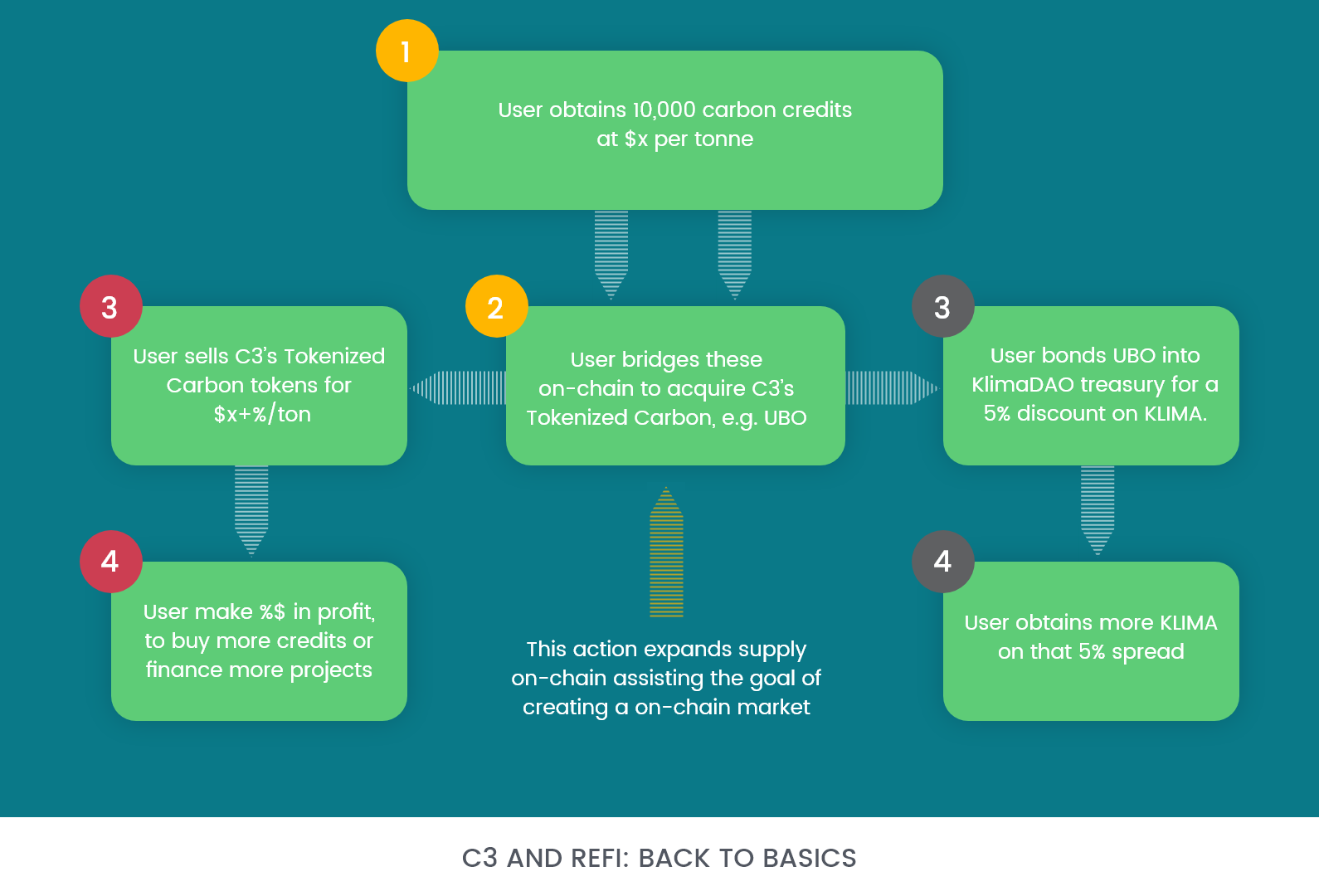

The biggest carbon token, BCT, has almost 18 million tons in circulation. A no small feat in itself. Let’s reflect on what brings carbon tonnage on chain in the first place:

- An arbitrage opportunity between the legacy market and the on-chain market.

- A bonding opportunity from KlimaDAO to obtain KLIMA at a discounted rate from market price.

Compare this to what most believe the true demand of tokenizing BCT should come from:

- The ability for anyone, retail or companies, to buy a carbon offset at a visible, fair price to gain exposure to the carbon market.

- The ability to offset one tonne of carbon without heavy friction that comes in legacy markets today.

- The ability to participate in a free market, without middlemen or significant roadblocks limiting you from doing so.

And you can see the large discrepancy here. The reason for this is largely due to the lack of legitimacy, adoption, and age of ReFi. This is solved with growth and lindy, where the success of an asset is correlated with the time it has lived. Until we get into that state, we have to rely on external demand in order to push people to bridge tokens on-chain (arbitrage and bonding).

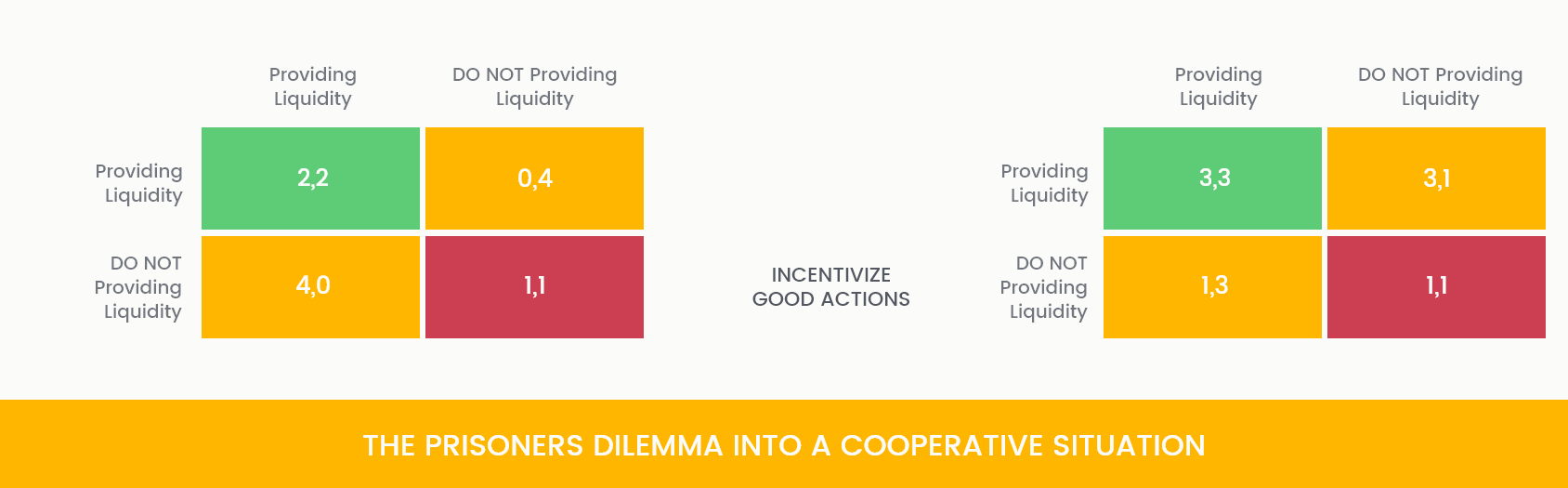

DeFi turns this around by incentivizing beneficial behaviors for the system. The most common example is Pool 2 liquidity mining, where users provide liquidity for the protocol token in exchange for significant rewards. Typically, participants would not have provided liquidity, but the incentives make it economically justifiable. The in-game theory is akin to shifting the Nash equilibrium.

How does this relate to bringing carbon on-chain? Simple. We incentivize activities that benefit the on-chain carbon-economy:

- Bridging

- Holding carbon assets on-chain (via staking)

- Providing Liquidity

- Offsetting

C3’s tokenomics will be utilized to incentivize these actions. By participating in these activities (whether with our C3 tokens, or perhaps even other tokens), users will have the opportunity to gain a share of the C3 ecosystem. We believe that this will incentivize people to rapidly adjust to the ReFi space and join the new era of finance.

Klimates, try not to fade us. We still have much in store.